After the Civil War ended in 1865, some states passed harsh laws that severely limited the rights of black people, segregated them, restricted the kind of property black people could own, including restricting them to only own property within a city limit to prevent them from earning money through farming on their own, forced them into involuntary servitude, and if they escaped they would be arrested. It was not until 1868 that the 14th Amendment attempted to halt the states’ statutes restrictions of rights of blacks to give them equal protection under the law. However, it wasn't until the 15th Amendment, ratified in 1870, that states were specifically prohibited from restricting the rights of voters based on race.

The 15th Amendment

The 15th Amendment states:

“The right of citizens of the United States to vote shall not be denied or abridged by the United States or by any State on account of race, color, or previous condition of servitude.”

The Post Civil war period of Reconstruction ended seven years subsequent to the 15th Amendment in 1877. One of the first reactions against the 14th and 15th Amendments were the enactment of state statutes and ordinances to deprive Blacks of their voting rights.

While the 15th Amendment prevented state legislatures from specifically making it illegal for blacks to vote, states and towns drew up legal schemes to disenfranchise black men of voting rights. (Note: In 1920, the 19th Amendment gave women the right to vote. It stated: "the right of citizens of the United States to vote shall not be denied or abridged by the United States or by any state on account of sex." However, even the 19th Amendment did not guarantee Black women the right to vote, and widespread black voter suppression for both men and women continued into the 20th century.)

In the 1870's, southern states enacted further harsh black crow laws. Efforts to enforce white supremacy and suppress black voting were unfortunately successful because many states’ passed legislation placing insurmountable barriers to voting by blacks.

Poll Taxes and Literacy Tests Were Two of the Numerous Jim Crow Laws Passed by States to Prevent Blacks from Voting.

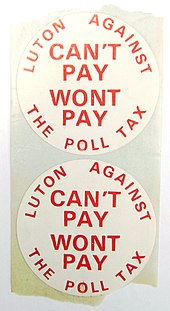

Poll Taxes

Poll taxes were a fee required to registrar to vote. Potential voters were required to pay their poll tax before they could cast a ballot. The payment of poll taxes were a prerequisite to register to vote in Jim Crow states. Blacks had been economically disenfranchised could not afford to pay the Poll taxes. Whites who could not pay were excused either by a grandfather clause allowing them to vote if their ancestor had voted prior to the Civil war, but there was no such exemption for blacks. Poll tax laws continued into the 20th century and 1960's.

Click here to see original 1949 poll tax receipts of Congressman Marc Veasey’s grandparents which hang in his Congressional office in Washington D.C.

Click here to view a 1931 payment of poll tax receipt.

To view a 1940's political button to stop poll taxes click here .

The 24th Amendment

In 1964 the 24th Amendment was enacted and it prohibited the use of poll taxes as a prerequisite to vote in federal elections only. The 24th Amendment states:

Amendment XXIV

Section 1.

The right of citizens of the United States to vote in any primary or other election for President or Vice President, for electors for President or Vice President, or for Senator or Representative in Congress, shall not be denied or abridged by the United States or any state by reason of failure to pay any poll tax or other tax.

Section 2.

The Congress shall have power to enforce this article by appropriate legislation.

It was not until January 23, 1964, that the 24th Amendment abolished Poll taxes in federal elections. Because the 24th Amendment only prohibited states from requiring payment of a polling tax fee to vote in federal elections, thereafter some states took advantage of the limited federal language to enforce payment of poll taxes as a prerequisite to vote in their state and local elections well into the 20th century and 1960's.

Even by 1966, some southern states required poll taxes as a prerequisite to voting in state and local elections. To view a 1960's Poll Tax sign, click here.

Click here to see a “Be ready to vote. Pay your poll tax by January 31st ” sign, and another “Pay your poll tax deadline January 31ST sign in Texas here.

After the passage of the 24th Amendment, poll tax laws continued to be enforced by some states until the U.S. Supreme Court in Harper v. Virginia State Board of Elections, 383 U.S. 663 (1966), held state poll taxes to be unconstitutional under the 14th Amendment.

What You Can Do

I am an aggressive and compassionate employment law attorney who is experienced in successfully representing persons who were subjected to racial harassment and retaliation in the workplace and/or were fired. If you have experienced racism at work, or if you reported it and no action was taken, if you are thinking of resigning, or think you will be fired, or have been fired, it is important that you consult with an attorney who is experienced in discrimination.

If you are being subjected to workplace discrimination, contact Hope A. Lang, Attorney at Law today for a free consultation.

Hope A. Lang, Attorney at Law serves clients throughout New Jersey, including Bergen, Middlesex, Essex, Hudson, Monmouth, Ocean, Union, Camden, Passaic, and Morris Counties with locations in southern, central, western and northern NJ to meet with clients.